Starting or growing a business often comes with one major challenge — funding. The good news is that many organizations and government bodies offer small business grants that provide free money to help entrepreneurs get started or expand. Unlike loans, grants don’t need to be repaid, making them one of the best sources of business funding for new or existing ventures.

Small business grants are available in various forms — some support women-owned businesses, others focus on tech innovation, rural development, or sustainability. The key is knowing where to find them and how to apply effectively. Before applying, make sure your business idea aligns with the goals of the grant provider.

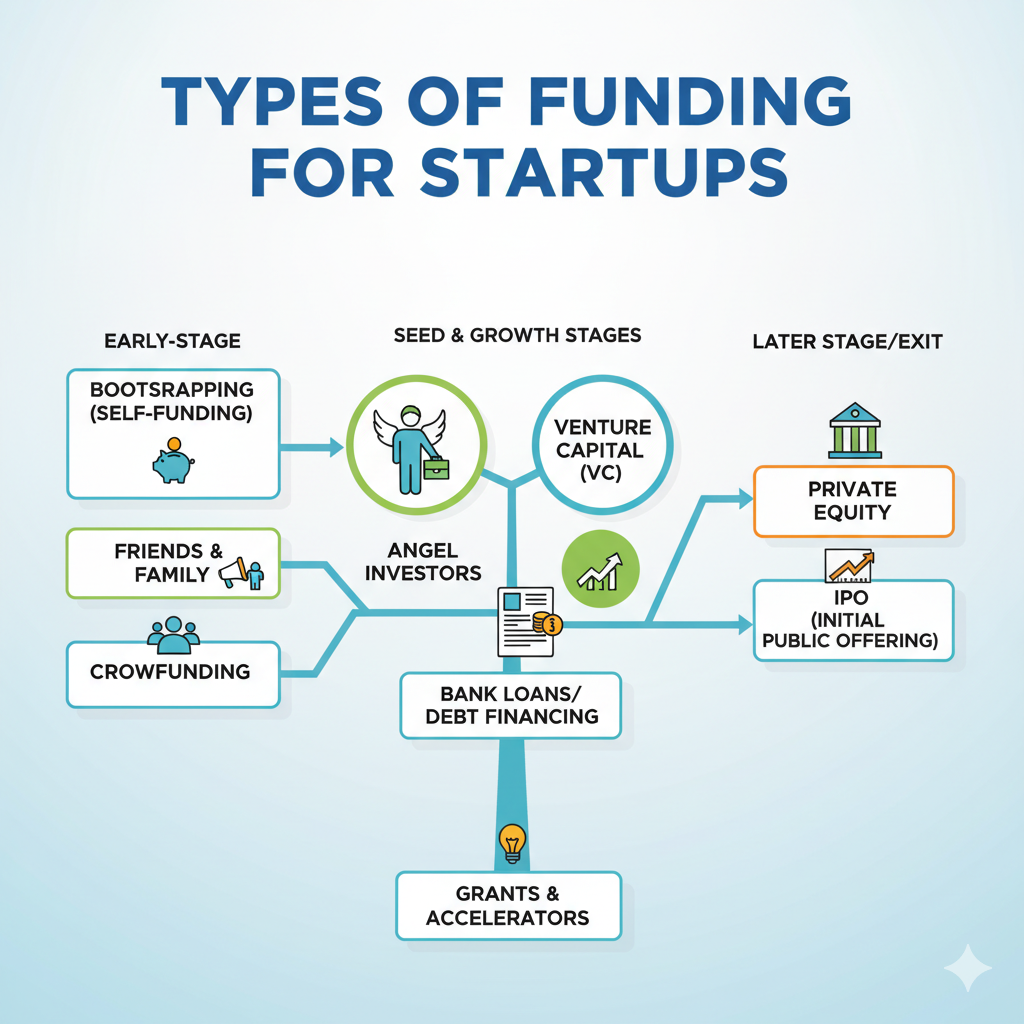

Types of Funding for Startups

If grants aren’t available, there are other types of funding for startups worth exploring. Options include pre seed funding for startups, early stage funding for startups, venture capital, angel investors, or crowdfunding. Each comes with different requirements and benefits.

Pre seed funding helps turn an idea into a prototype or a small pilot project. As your business grows, early stage funding can help scale operations, hire talent, and market your product. Choosing the right funding path depends on your business model, goals, and growth stage.

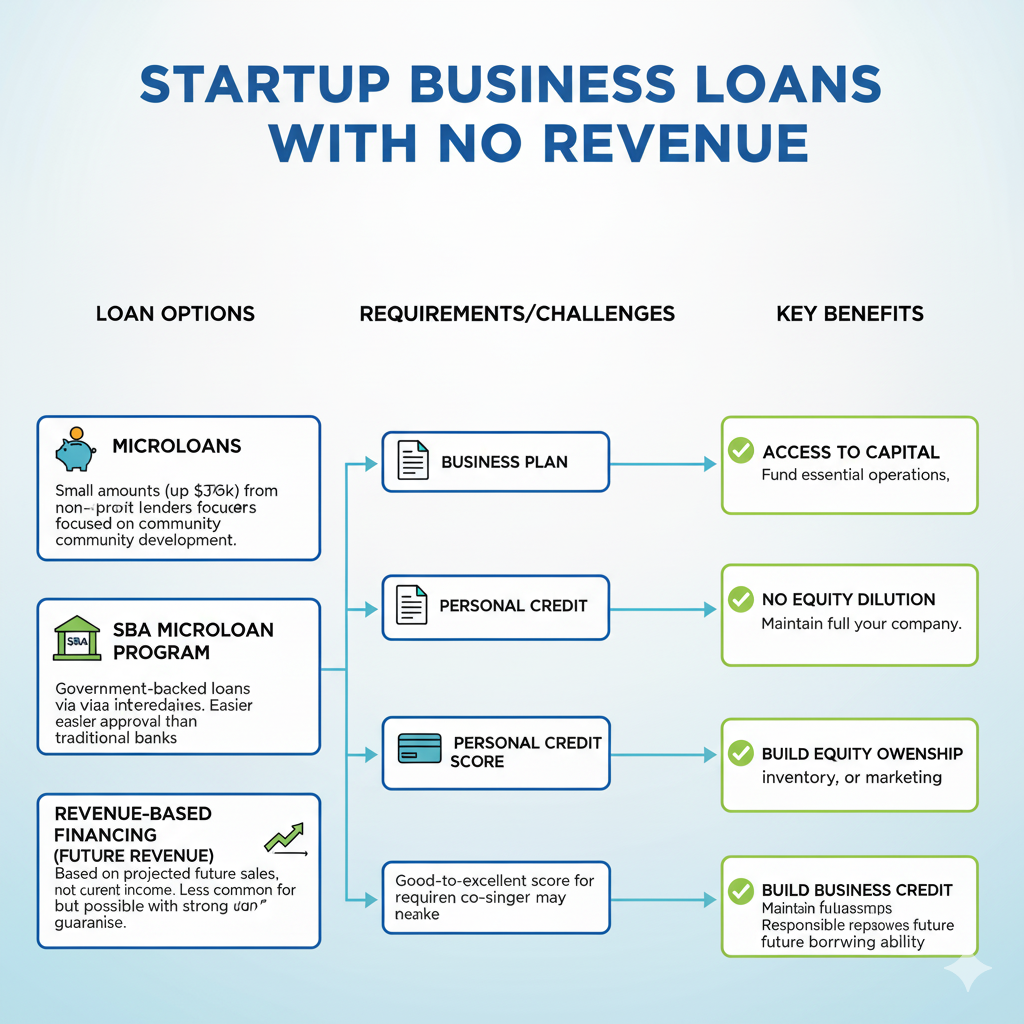

Startup Business Loans with No Revenue

Many new entrepreneurs worry about qualifying for loans without an established income. Fortunately, some lenders specialize in startup business loans with no revenue. These loans are designed to support early-stage founders who have strong ideas but limited financial history.

Private lenders like Everest Business Funding and Torro Business Funding offer flexible loan options tailored for small businesses and startups. They often look at your business plan, industry potential, and personal credit score instead of focusing only on revenue.

While grants remain the best form of “free money,” exploring funding partners such as Everest or Torro can be a great way to bridge financial gaps and keep your startup moving forward.

The best types of funding for startups depend on your business stage and goals. Early-stage founders often start with small business grants or pre-seed funding to cover initial costs. As the company grows, you can explore venture capital, angel investors, or startup business loans with no revenue to scale faster.

If your startup has no revenue yet, you can still qualify for startup business loans with no revenue from private lenders like Everest Business Funding or Torro Business Funding. You can also apply for small business grants or early-stage funding programs that support new entrepreneurs.

8 Responses

Our LAX Shuttle is designed for stress-free airport transfers. Choose us for transportation to LAX that is affordable and convenient. From standard airport transportation LAX and airport shuttle LAX to longer routes like airport shuttle Bakersfield to LAX, our trusted LAX transportation service provides reliability and comfort for every traveler.

Thanks For Your Comment

This article was really helpful. It breaks down small business grants in such a simple, practical way. I think a lot of small business owners could benefit from reading this — thanks for sharing such useful information!

Welcome Rittik

This actually answered my downside, thank you!

Thanks A Lot…

you got a very superb website, Sword lily I detected it through yahoo.

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.