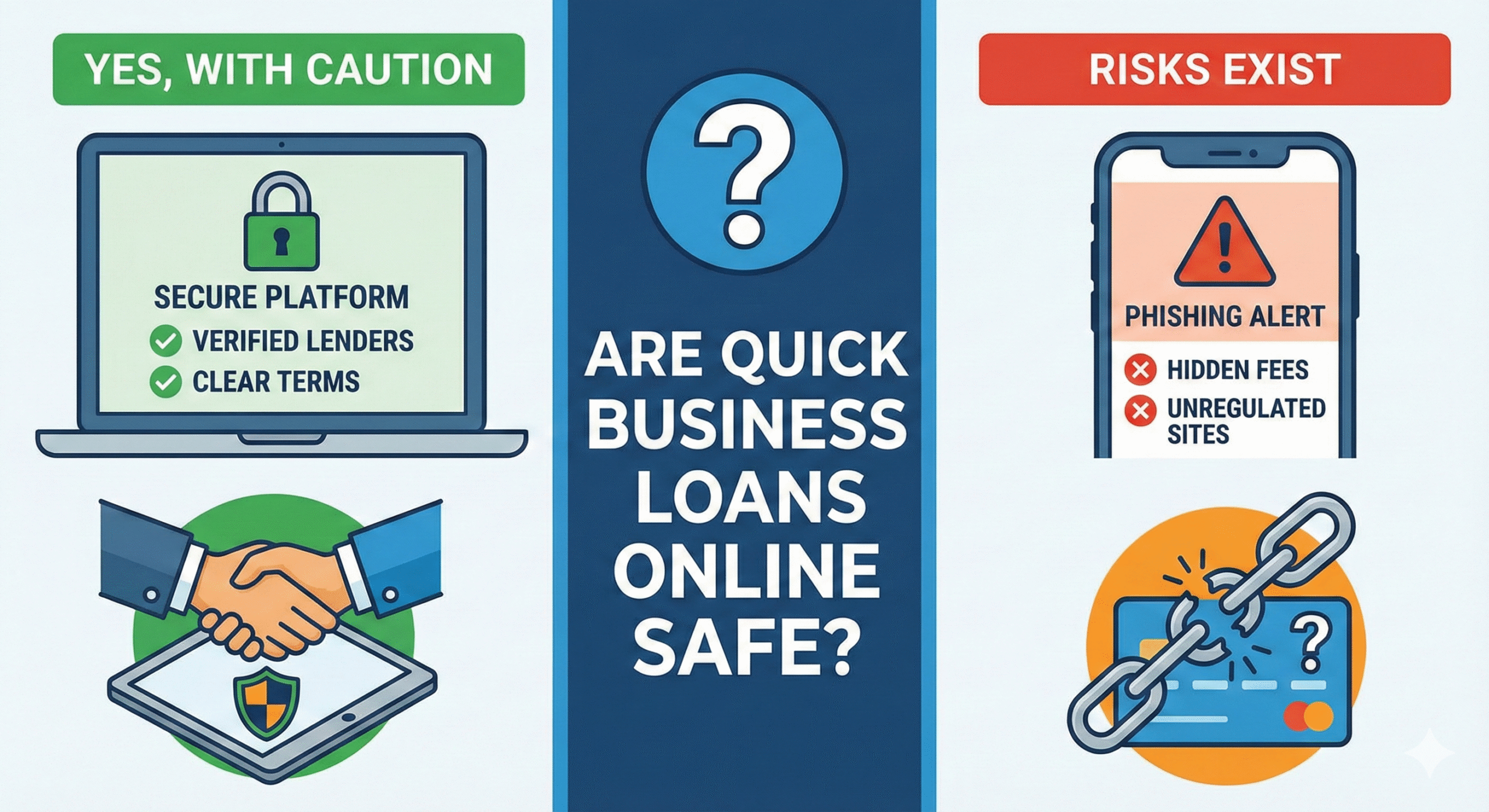

When cash flow gets tight, many business owners turn to quick business loans online because they offer fast funding without the hassle of traditional banking. The idea of same-day approvals and easy applications is appealing, but one question always comes up: Are these loans safe?

The good news is that they can be safe, as long as you choose the right lender and understand the terms clearly.

Why Quick Online Loans Have Become So Popular

Online lenders have made accessing capital much easier. Instead of waiting weeks for bank approval, many platforms offer quick decisions, simple forms, and flexible loan options. For small businesses and startups, this speed matters during emergencies, inventory needs, payroll deadlines, or sudden growth opportunities. The convenience is a big reason why more owners are turning toward quick business loans online instead of traditional financing.

How to Know If an Online Business Loan Is Safe

The first step is to check the lender’s credibility. A legitimate lender will have a professional website, visible company details, real customer feedback, and transparent loan policies. If a lender hides information or rushes you into applying, that’s a sign to walk away.

Next, take time to read the terms. Understanding the repayment cycle, fees, interest rate, and total borrowing cost is essential. Safe lenders communicate everything clearly and answer questions without hesitation. If anything feels unclear or confusing, it’s better to pause and reassess. Security also matters. A trusted lender will protect your data through secure, encrypted applications. Before entering sensitive details, confirm that the website is secure and that the privacy policy is easy to understand.

Finally, comparing lenders is one of the best ways to stay safe. Even if you need fast funding, spending a few extra minutes checking different options can help you avoid high rates or unnecessary fees. Each lender offers different loan terms, so a quick comparison can make a big difference in what you end up paying.

Red Flags You Should Not Ignore

Some signs immediately signal that a lender may not be safe. Be careful if a lender asks for unusually high upfront fees, promises guaranteed approval without checking your business, hides repayment details, or pushes you to apply immediately. Anything that feels too aggressive or too vague is worth stepping back from.

Why Reputable Online Lenders Are Worth Considering

When you choose a trusted lender, quick business loans can be a secure and helpful tool. They give you access to working capital when you need it most, without long bank delays. The application process is straightforward, and the terms are usually easier to understand than traditional loans. This kind of funding can support growth, manage short-term challenges, and help your business stay stable during busy or unpredictable periods.

Final Thoughts

Quick business loans online are safe when you take the time to verify the lender, understand the terms, and avoid offers that seem suspicious. With a little research, fast online funding can be a reliable way to keep your business running smoothly or move it toward new opportunities. The key is staying informed and choosing lenders that value transparency and fairness.