Emergency Business Funding Options for US Businesses

Running a business in the USA is rewarding, but emergencies can strike without warning. A sudden drop in cash flow, unexpected repairs, delayed payments, or economic disruptions can put even strong businesses under pressure. This is where emergency business funding becomes a lifeline. Knowing your options ahead of time helps you act fast and protect […]

Minority Business Funding Programs in the USA: A Simple Guide for Business Owners

Starting or growing a business is exciting, but finding the right funding can feel overwhelming, especially for minority entrepreneurs. The good news is that minority business funding programs in the USA are designed to make capital more accessible and fair. Whether you are launching a startup or expanding an existing business, these programs can help […]

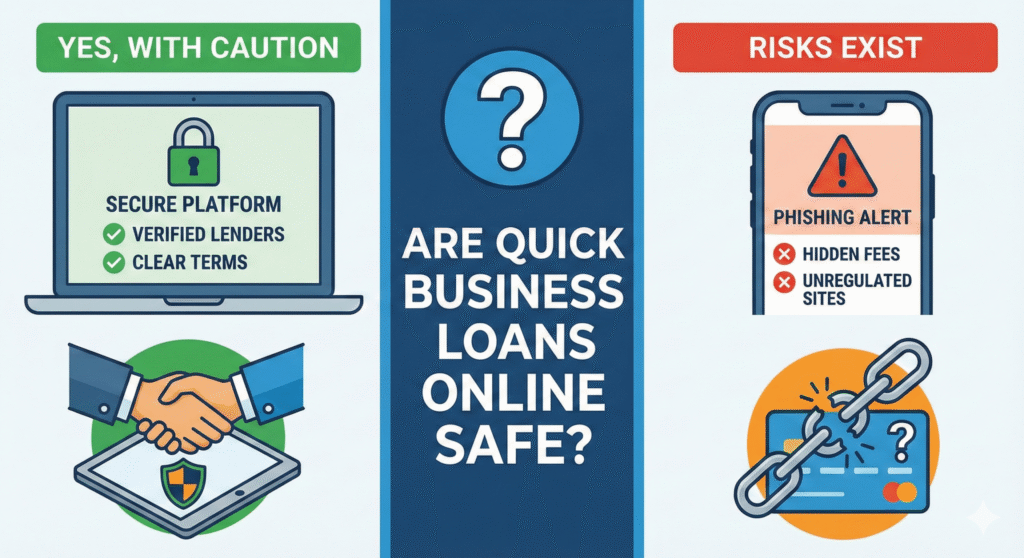

Are Quick Business Loans Online Safe? What You Need to Know

If you are running a startup, cash flow pressure is real. You need funds fast to pay suppliers, launch marketing, hire talent, or simply stay afloat. That urgency is exactly why many founders start searching for quick business loans for startups online. But the big question always follows: are these loans actually safe? The short […]

Documents You Need to Get a Quick Business Loan Online

Applying for quick business loans online has become one of the simplest ways for small business owners to access fast funding. But even though the process is much easier than traditional bank loans, lenders still need a few essential documents to verify your identity, check your business performance, and understand your repayment ability. Getting these […]

Are Quick Business Loans Online Safe? What You Need to Know

When cash flow gets tight, many business owners turn to quick business loans online because they offer fast funding without the hassle of traditional banking. The idea of same-day approvals and easy applications is appealing, but one question always comes up: Are these loans safe?The good news is that they can be safe, as long […]

5 Common Mistakes to Avoid When Applying for Quick Business Loans Online

Applying for quick business loans online can be one of the fastest ways to get the funds your company needs. Whether you’re facing a cash flow gap, planning expansion, or handling unexpected expenses, online lenders offer speed, convenience, and simple qualification requirements. But many business owners make avoidable mistakes during the loan process, and those […]

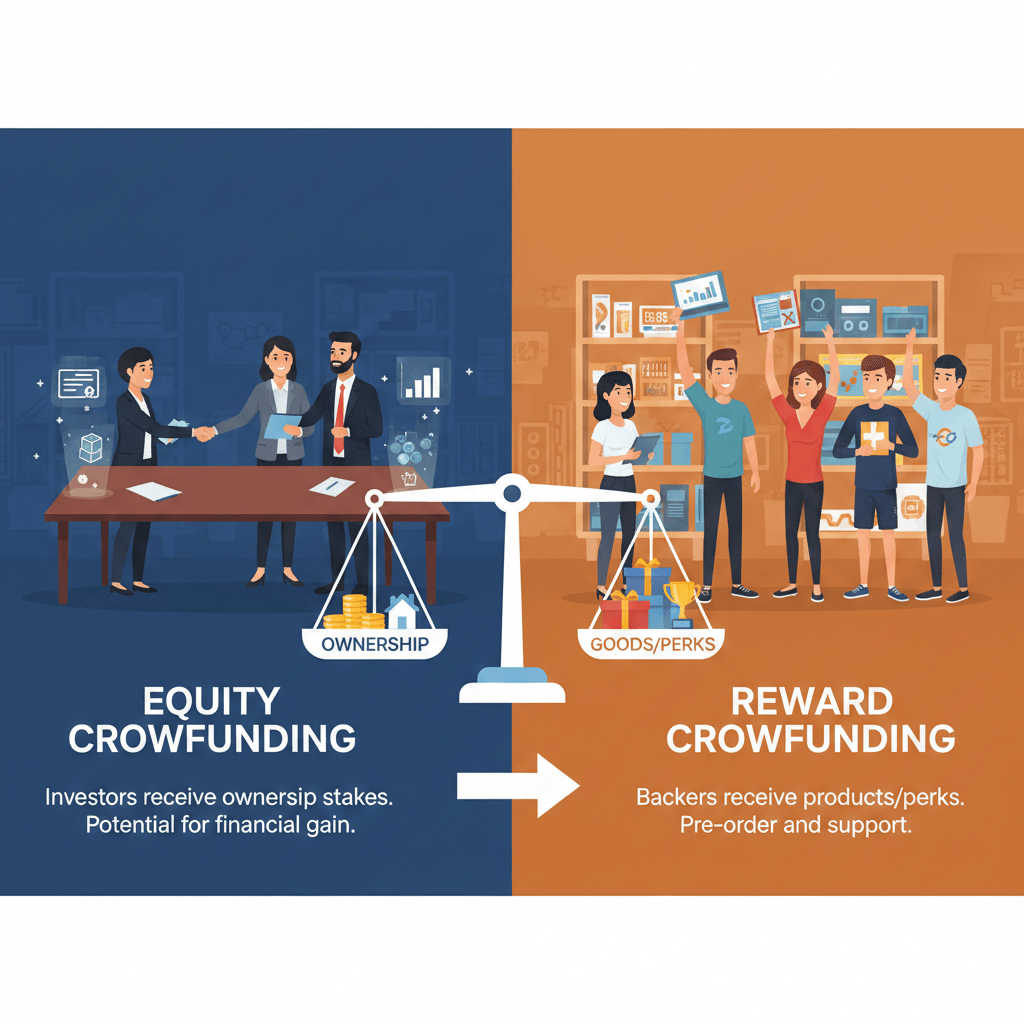

Equity vs. Reward Crowdfunding for Business: Which Option Is Better?

Crowdfunding for business has become a popular way for startups and small companies to raise money without relying on traditional loans. If you’re exploring crowdfunding for business startups, you’ll notice two common models: equity crowdfunding and reward crowdfunding. Both can help you secure the funds you need, but they work very differently. Here’s a simple, […]

How to Use Crowdfunding for Business Growth: Steps, Tips, and Best Platforms

Crowdfunding for business has become one of the most effective ways for entrepreneurs to raise capital without relying on banks or traditional investors. Whether you are launching a new product, expanding operations, or building a startup from scratch, crowdfunding helps you gather small contributions from a large number of supporters. Below is a clear, practical, […]

Best Small Business Loans for Women: Top Funding Options That Work

Finding the best small business loans for women has become easier in recent years, thanks to lenders and programs designed to support women entrepreneurs. Whether you’re starting out or growing your business, the right funding can help you move forward with confidence. Below is a simple breakdown of the most reliable loan and grant options […]

Small Business Loans for Women: Bad Credit Funding Solutions That Help You Grow

Building a business takes courage, especially when your credit score isn’t perfect. Many women entrepreneurs face this challenge, but the good news is that small business loans for women with bad credit are still possible. With the right approach, you can access practical funding options that support growth, stability, and long-term success. Why Bad Credit […]