How to Qualify for Business Funding in the USA Quickly

Getting business funding quickly is a top priority for many US business owners. Whether you need capital to manage cash flow, cover urgent expenses, or seize a growth opportunity, knowing how to qualify for business funding faster can make a real difference. The good news is that approval doesn’t always require perfect credit or years […]

How Much Business Funding Can You Get in the USA Based on Revenue

One of the most common questions business owners ask is simple: how much funding can I actually qualify for? In the USA, the answer often depends less on credit scores and more on business funding based on revenue. Lenders want to see how much money your business consistently brings in and how well it can […]

Business Funding for New LLCs in the USA

Starting a new LLC is an exciting step, but one of the first challenges many owners face is securing capital. New businesses often need funding for setup costs, equipment, marketing, inventory, or simply to manage early cash flow. The good news is that business funding for new LLCs in the USA is more accessible today […]

No-Doc Business Funding Options in the USA

For many business owners, paperwork is one of the biggest barriers to getting funding. Traditional lenders often ask for tax returns, financial statements, and long credit histories. That’s why No-Doc Business Funding has become a popular option for businesses across the USA that need fast capital without heavy documentation. No-doc funding is designed for speed […]

Common Reasons Business Funding Gets Rejected in the USA

Getting funding can be a big step forward for any business, whether you’re trying to expand, hire, restock inventory, or simply stabilize cash flow. But for many business owners, the most frustrating part is applying and getting denied without fully understanding why. A business funding rejection doesn’t always mean your business is failing. In many […]

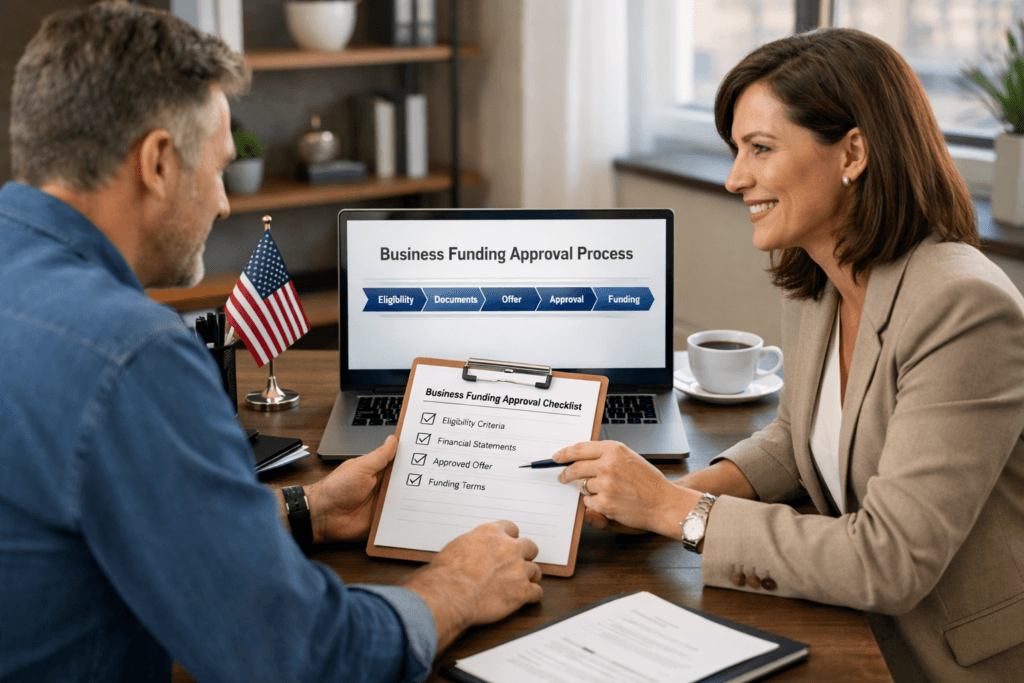

Business Funding Approval Process Explained for US Businesses

Getting funding for your business can feel confusing, especially when you need capital fast. The good news is that the business funding approval process is much simpler when you know what lenders look for and how to prepare. Whether you’re applying for a loan, working capital, or another funding solution, understanding the steps can help […]

Business Funding Without Collateral in the USA

Access to capital is one of the biggest challenges for small and growing businesses. Many business owners hesitate to apply for funding because they do not have property, equipment, or other assets to pledge as collateral. The good news is that business funding without collateral in the USA has become more accessible than ever, making […]

Business Funding for Restaurants in the USA

Running a restaurant in the USA is exciting, but it is also one of the most capital-intensive businesses. From managing daily operations to handling seasonal ups and downs, restaurant owners often need reliable access to funding. Restaurant business funding helps bridge cash flow gaps, support growth plans, and keep operations running smoothly, even during challenging […]

Business Funding for Trucking Companies in the USA

Running a trucking company in the USA is capital-intensive. From buying trucks and trailers to managing fuel costs, insurance, repairs, and payroll, cash flow can quickly become a challenge. That’s where business funding for trucking companies plays a critical role in keeping operations moving and profits growing. Why Trucking Companies Need Reliable Business Funding Trucking […]

Business Funding for E-Commerce Businesses in the USA

Running an eCommerce business in the USA offers massive growth potential, but cash flow challenges can slow things down quickly. From managing inventory to scaling ads and handling seasonal demand, online businesses need steady access to capital. This is where eCommerce business funding becomes a game changer. Unlike traditional brick-and-mortar businesses, eCommerce brands operate at […]