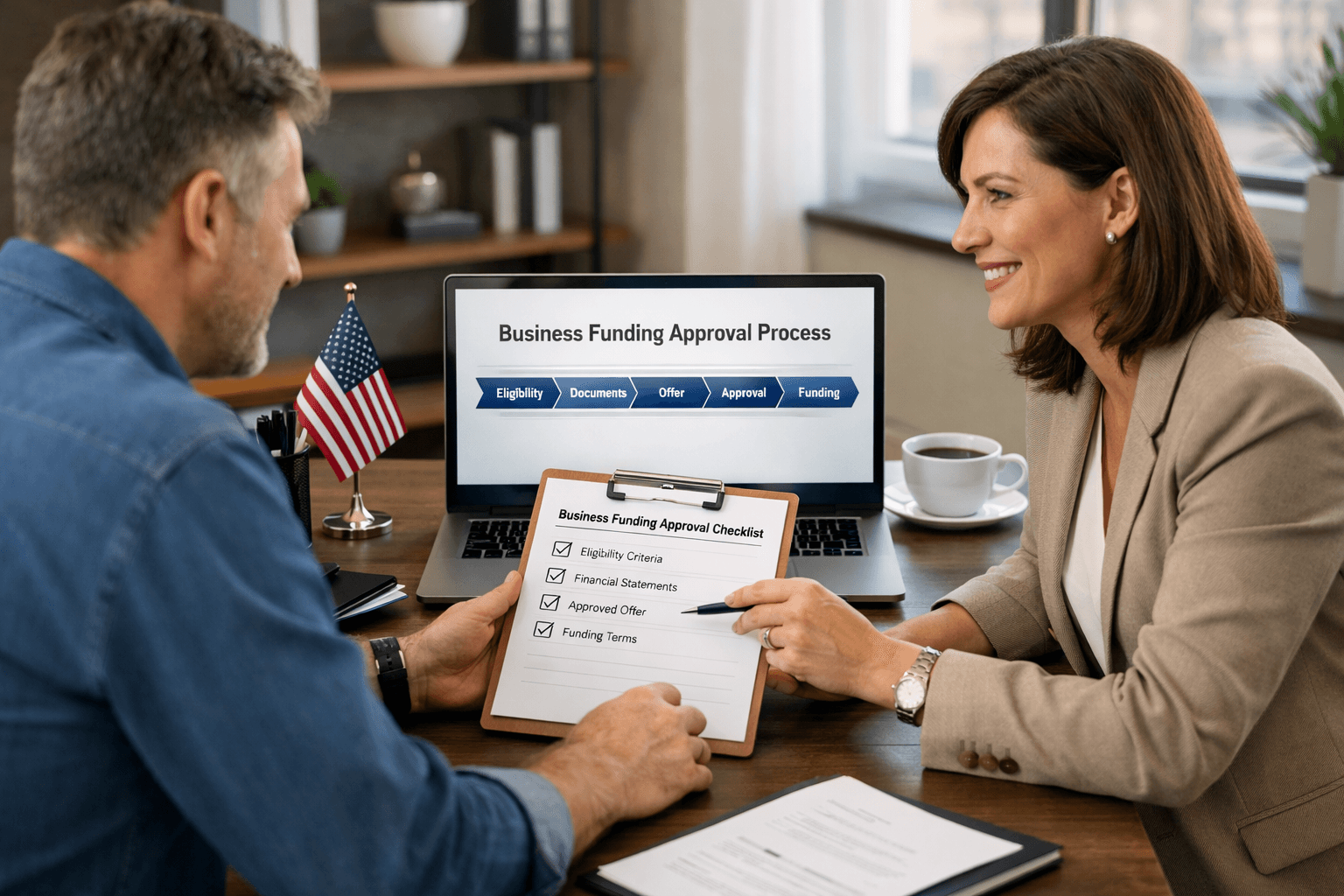

Getting funding for your business can feel confusing, especially when you need capital fast. The good news is that the business funding approval process is much simpler when you know what lenders look for and how to prepare. Whether you’re applying for a loan, working capital, or another funding solution, understanding the steps can help you get approved faster and avoid delays.

Step 1: Basic Eligibility Review

The first stage of business funding approval starts with a quick check of your business details. Most lenders look at how long you’ve been in business, your monthly revenue, and the industry you operate in. Even if your business is new, some funding options may still be available based on cash flow and sales performance.

Step 2: Document Collection and Verification

After eligibility, the lender will request a few key documents. These usually include recent bank statements, basic business information, and sometimes tax documents. The goal is to verify that your business has consistent income and can handle repayment. Submitting complete documents upfront can significantly speed up your approval timeline.

Step 3: Funding Match and Offer Review

Once your documents are reviewed, you’ll typically receive one or more funding offers. This is where the real comparison happens. A smart business owner looks beyond just the amount approved and checks repayment terms, total cost, and payment frequency. Choosing the right offer helps protect your cash flow while meeting your business goals.

Step 4: Final Approval and Funding

After you accept an offer, the lender completes final checks and sends the funding agreement. Once signed, funds are released based on the provider’s timeline. In many cases, businesses can receive funding quickly, especially through streamlined approval systems.

How to Improve Your Business Funding Approval Chances

To increase your business funding approval rate, keep your business financials organized, maintain steady cash flow, and avoid sudden drops in deposits before applying. It also helps to apply for the right funding type based on your business needs, not just the biggest amount.

Final Thoughts

The business funding approval process doesn’t have to be stressful. With the right preparation and guidance, US businesses can access funding faster, make smarter decisions, and grow with confidence.